Daily Slingshot System*

I've been using this system for 794 weeks now and started live trading 793 weeks ago. The system is pretty simple and straight forward and is totally price driven, relying on no idicators at all. It is not intended for use on every pair, but back testing shows favorable results with four specific pairs. In order from best performance: GBP/USD, EUR/CHF, EUR/USD, USD/JPY. Back testing shows optimal performance using 1.5 lotsize (I'm trading mini lots) per $1000. The account dropped as low as into the $600's, but bounced backed for significant profit from there. There will not be trades every day, but back testing shows anywhere from 8-12 trades per month. Given the high degree of profit vs. loss, this is plenty. There will be many times that the chart will show several long candles in a row during a strong trend. This system is NOT a trend system. You will miss out on those potentials, but can make up for them during the more volatile times. Don't get greedy. Greed can ruin a trader faster than most anything else.

What You Need

The files you need are:

- Slingshot EA - place in your

MT4/experts folder.

- Slingshot indicator - place in your

MT4/experts/indicators folder. Be aware...the EA and the indicator have the same name, so install one before downloading the other or give them names you can distinguish.

- Slingshot template - place in your

MT4/templates folder. NOT the experts/templates folder.

Open MT4 and bring up the chart you'll be trading (I'm only trading GBP/USD on a mini account for now) and apply the slingshot template. Make sure that you have Expert Advisors enabled in your options and have selected "Allow live trading" and have not selected "Ask manual confirmation." Apply the Slingshot EA to the chart. That's all there is to it. Just leave MT4 running and if you decide to close a trade manually, be sure to remove the EA and re-apply it the following day.

How It Works

The system is applied only to a daily chart. If the range from high to low of the previous day's candle is greater than (or equal to) 20 pips, it is a valid setup candle indicating that a trade setup will be looked for today. The setup is as follows:

If yesterday's closing price was higher than the opening price (bullish candle) you will be shorting today. An entry may only occur between 0700 and 2000 GMT. In order to enter a trade, today's high must exceed yesterday's high, even if only by one pip. If that part doesn't happen, there will be no trade today. Once it does, the next signal is the cuurent price dropping below yesterday's closing price. The short trade is entered at one pip below yesterday's closing price, with a stop loss equal to one pip above today's high. If that price comes before 0700 GMT, the entry will be at 0700 as long as the price at that time is still under yesterday's closing price. In order to allow a little volatility (and because I trade with IBFX and they have a minimum pip range for SL) if the daily high is less than 10 pips higher than the entry price, it is automatically set to 10 pips above the entry price.

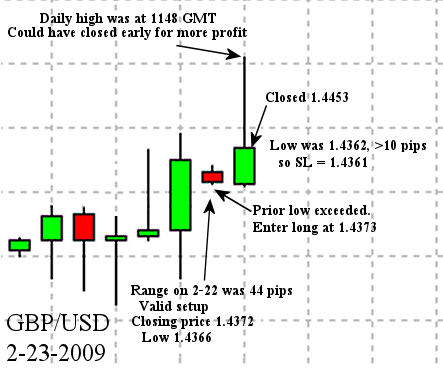

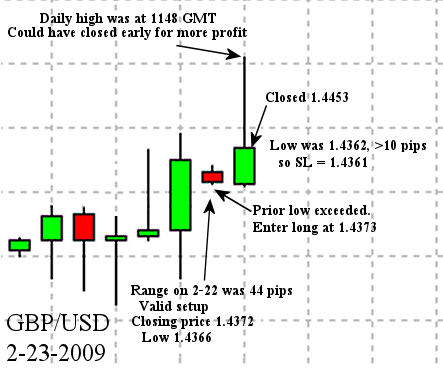

If yesterday's closing price was below the opening price (bearish candle), everything is simply reversed. You must wait for today's low to be at least one pip lower than yesterday's low, then the trade is entered long at one pip above yesterday's closing price, with the stop loss being one pip below today's low or 10 pips below the entry price, whichever is less.

The EA has a semi-trailing stop included so that whenever you are in profit 50 pips, the stop loss is moved 50 pips (lower for short trades, higher for long trades). The performance is good enough not to complicate the EA with a pip-by-pip actual trailing stop. Once the trade is entered it runs until the next candle and then closes. In practical use, I sometimes manually close the trade around 1300 GMT (that's around 6 am for me, when I'm getting ready for work). I've found times that if I took profit then, I was better off than letting the trade run until candle close when it turned into a loss. Even if you don't do this, the back testing is overall profitable.

I tested different situations in regard to Friday trading. There were times that, since the trade closes at the opening of the next day's candle, there was a gap that hit the stop loss. However, there were enough times where the gap added to the profit that I left the EA the way it was so trades stay open over the weekend. If you look at the chart on Friday before the end of trading and think the gap will go against you, by all means, close the trade Friday. The EA is most useful in that it handles all of the work while I'm either sleeping or at work, so I don't mess with it too much.

You can check out the thread on this system at Baby Pips. I highly recommend going through their "School of Pipsology" if you're new to Forex. There is a lot of great information in general there.

Examples

Here are some chart examples:

In this example, the price actually slingshot upwards in a hurry. The pictured entry price was hit well before 0700, so the trade wasn't entered until 0700 at a price of 1.4555. On this particular day, when I checked the trade in the morning, the price had fallen significantly from the daily high of 1.4660, so I closed at 1.4599 for +44 pips. Had I let it run, I would've actually lost 4 pips since the next candle opened at 1.4551. It's important when manually backtesting to run everything on a 1 minute chart to avoid errors. The picture looks like a perfect example of a profitable day, but the minute chart shows the details that make it a losing day if you don't step in and manually end the trade.

In this example, the price actually slingshot upwards in a hurry. The pictured entry price was hit well before 0700, so the trade wasn't entered until 0700 at a price of 1.4555. On this particular day, when I checked the trade in the morning, the price had fallen significantly from the daily high of 1.4660, so I closed at 1.4599 for +44 pips. Had I let it run, I would've actually lost 4 pips since the next candle opened at 1.4551. It's important when manually backtesting to run everything on a 1 minute chart to avoid errors. The picture looks like a perfect example of a profitable day, but the minute chart shows the details that make it a losing day if you don't step in and manually end the trade.

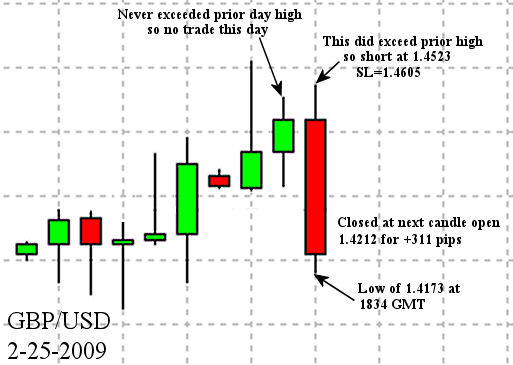

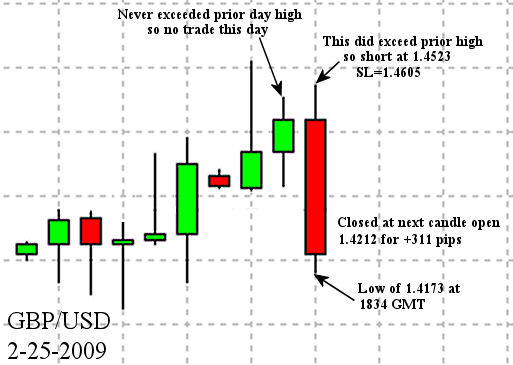

This is a perfect example of the ideal slingshot. The price slowly climbed above yesterday's high of 1.4576 then

rebounded nicely. The sell price wasn't even hit until 0943 and it just kept falling from there. The stoploss was modified seven times with a final value of 1.4255 so the worst I could've done was +268 pips if it turned around at the end of the day. The price went as low as 1.4173 but it only came up 39 points from there. An excellent day!

This is a perfect example of the ideal slingshot. The price slowly climbed above yesterday's high of 1.4576 then

rebounded nicely. The sell price wasn't even hit until 0943 and it just kept falling from there. The stoploss was modified seven times with a final value of 1.4255 so the worst I could've done was +268 pips if it turned around at the end of the day. The price went as low as 1.4173 but it only came up 39 points from there. An excellent day!

Important update: In order to assure proper functioning if/when trading on more than one chart, I have coded a separate EA for each of the 4 pairs. They are identical except for the variable that keeps track of the current ticket number. If you use the original EA on more than one chart and a trade is opened on each, only the last one opened will be able to have the SL modified, which could lead to unneccesary losses. If you want to trade on additional charts, open the EA with MetaEditor and change the variable ticket to something else specific and different for each pair. i.e. I used guTicket for the GBP/USD, ujTicket for USD/JPY etc. There are several instances of this variable throughout the program, so be sure to change them all. Then re-save the EA with a new name specific for that pair and recompile. Only run the pair specific EA when trading on multiple charts. I still only trade the four listed here. If you have any questions, you can e-mail me.

Sorry...unable to connect to database. Please try again later. In this example, the price actually slingshot upwards in a hurry. The pictured entry price was hit well before 0700, so the trade wasn't entered until 0700 at a price of 1.4555. On this particular day, when I checked the trade in the morning, the price had fallen significantly from the daily high of 1.4660, so I closed at 1.4599 for +44 pips. Had I let it run, I would've actually lost 4 pips since the next candle opened at 1.4551. It's important when manually backtesting to run everything on a 1 minute chart to avoid errors. The picture looks like a perfect example of a profitable day, but the minute chart shows the details that make it a losing day if you don't step in and manually end the trade.

In this example, the price actually slingshot upwards in a hurry. The pictured entry price was hit well before 0700, so the trade wasn't entered until 0700 at a price of 1.4555. On this particular day, when I checked the trade in the morning, the price had fallen significantly from the daily high of 1.4660, so I closed at 1.4599 for +44 pips. Had I let it run, I would've actually lost 4 pips since the next candle opened at 1.4551. It's important when manually backtesting to run everything on a 1 minute chart to avoid errors. The picture looks like a perfect example of a profitable day, but the minute chart shows the details that make it a losing day if you don't step in and manually end the trade. This is a perfect example of the ideal slingshot. The price slowly climbed above yesterday's high of 1.4576 then

rebounded nicely. The sell price wasn't even hit until 0943 and it just kept falling from there. The stoploss was modified seven times with a final value of 1.4255 so the worst I could've done was +268 pips if it turned around at the end of the day. The price went as low as 1.4173 but it only came up 39 points from there. An excellent day!

This is a perfect example of the ideal slingshot. The price slowly climbed above yesterday's high of 1.4576 then

rebounded nicely. The sell price wasn't even hit until 0943 and it just kept falling from there. The stoploss was modified seven times with a final value of 1.4255 so the worst I could've done was +268 pips if it turned around at the end of the day. The price went as low as 1.4173 but it only came up 39 points from there. An excellent day!